[FY2023] Company posts annual revenue of KRW 22.7 trillion, operating profit at KRW 1.63 trillion, setting a record high in revenue

[Q4] Quarterly revenue of KRW 5.56 trillion, operating profit at KRW 311.8 billion

2023 EV battery business sees revenue growth while sustaining profitability improvement

Samsung SDI CEO Yoon-ho Choi remarks, “We will strive to achieve profitable and qualitative growth backed by ‘super-gap’ technological competitiveness, cost innovation, and new customer acquisition”

SEOUL, Korea – January 30, 2024 – Samsung SDI today reported financial results for the fourth quarter that ended December 31, 2023 and the results for the fiscal year 2023.

The company announced that it delivered annual revenue of KRW 22.7 trillion and operating profit of KRW 1.63 trillion. The year-to-year growth of the annual revenue was KRW 2.58 trillion (12.8%), making it the company’s highest result yet. The operating profit decreased by KRW 174.6 billion (△9.7%).

Overview of Fourth Quarter Earnings Results

Samsung SDI posted KRW 5.6 trillion in revenue and KRW 312 billion in operating profit in the fourth quarter of FY2023.

Comparing on a year-to-year basis, the revenue went down by KRW 401.1 billion (△7%) while the operating profit decrease was KRW 179 billion (△37%). From the previous quarter, the company’s revenue declined by KRW 383 billion (△6%) with the operating profit reporting a decrease of KRW 184 billion (△37%).

Fourth Quarter Earnings Results by Business

The energy business generated KRW 5.0 trillion in revenue, which increased by KRW 343 billion (△6%) from the corresponding period last year and decreased by KRW 341 billion (△6%) from the prior quarter. The posted operating profit was KRW 226 billion, declining both quarterly and yearly by KRW 186 billion (△45%) and KRW 133 billion (△37%), respectively.

The Automotive & ESS Battery Business produced the results similar to the previous quarter’s level. Thanks to continued expansion of sales of P5 product going into high-end electric vehicles, the automotive battery portion of the sales increased while the energy storage system battery sales decreased under the effect of soft utility sales. The operating profit fell versus the preceding quarter due to a short term effect on profits and losses induced by decline in raw materials prices.

Both revenue and operating profit posted by the Small Battery Business were affected by increased inventory levels in the market stoked by delayed demand recovery in power tools, micro-mobility and IT products.

The Electronic Materials Business reported KRW 567 billion, down by KRW 58 billion (△9%) year-on-year and by KRW 41.7 billion (△7%) quarter-on-quarter. Although the operating profit decreased by KRW 46 billion (△35%) yearly, it inched up sequentially by KRW 2 billion (2%) to KRW 86 billion.

The Electronics Materials closed the fourth quarter with the revenue on an upward trend with mass-production for new OLED-material platforms, while semiconductor materials delivered better quarter-to-quarter revenue and profit thanks to recovering market demand and new product application. Polarizer film sales, however, declined owing to the effect of sluggish demand.

Business Outlook for the First Quarter 2024

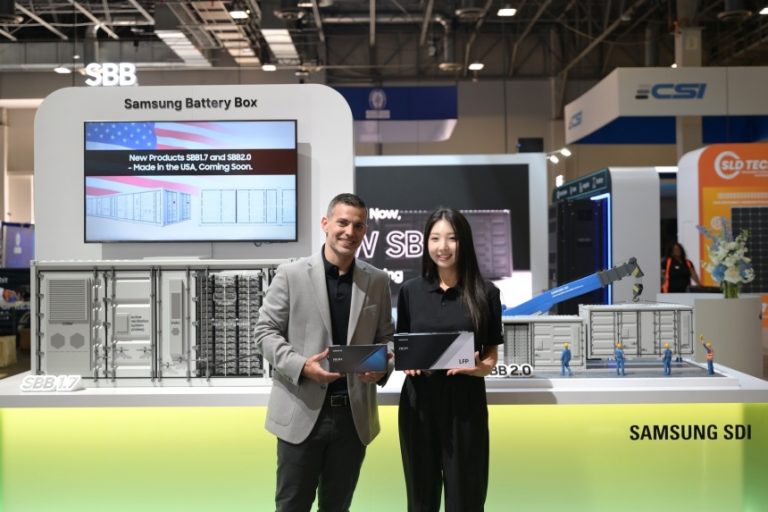

In the first quarter of FY2024, the Automotive & ESS Battery Business plans to further expand sales of a new product. With the start of full-fledged production of P6, a high-capacity premium battery product, the mid-to-large sized lithium-ion battery division seeks to expand sales and improve profitability in the course of their undertaking. The plan for the ESS battery focuses on increasing sales of Samsung Battery Box, a total ESS battery solution built with enhanced energy density and safety.

Entering the seasonally weak period, the Small Battery Business expects the first-quarter sales to decrease. Sales of the pouch battery segment will pivot on securing new customers in Southeast and West-Asia regions where the demand is anticipated to rise. With the 46-phi battery project, the small-sized battery division is planning on supplying samples for customers as well as pursuing new project wins. The pouch battery sales is expected to increase with a launch of new flagship smartphone models.

For the Electronic Materials Business, weak seasonality is set to negatively affect sales whereas semiconductor materials will likely see sales growth thanks to recovering market demand and expanding new product sales.

Business Outlook for the FY 2024

The EV battery market is projected to reach USD 185 billion in value, 18% year-over-year growth.

Amid the forecast of being temporarily muted due to persisting high interest rates and global recession, the market growth is forecast to recover gradually from the second half, with a low interest rate effect kicking in. Driven by global green initiatives, namely the U.S. IRA and EU’s 2025 CO2 regulations, the demand will likely continue increasing as well in the mid-to-long term.

Drawing on this prospect, Samsung SDI plans to enhance revenue and profitability by expanding sales of high-value products such as P5 and P6 while garnering project wins for new platforms as well as preparing for commencement of production in the U.S.

The ESS battery market is anticipated to reach a 26 billion-dollar size, growing 18% from a year ago.

Alongside key markets of North America, Europe, and China continuing to grow, the company expects new, booming demand in Korea and South America with the regions’ strong policy push for the ESS industry.

Samsung SDI is aiming to expand order acquisitions with SBB’s new product appeal and prepare an LFP product that can accommodate the market’s demand for affordable batteries.

In 2024, the projected value of the small battery market is USD 44 billion, a 3% increase by the year.

The company forecasts power tool demand to stagnate overall while demand for professional use grows with increased product variation and rising electrification fostered by strengthened environmental regulations.

The mobility market is expected to receive tailwind with increasing OEM adoption of cylindrical batteries to EVs and widening e-scooter demand in Southeast and west Asia.

Small batteries for IT applications will likely meet increasing demand compared to the last year, with expanding demand for smartphone batteries centering on flagship models.

Samsung SDI will strive to discover new applications and business opportunities and gain edge in the market via timely development of new products for cylindrical and pouch batteries.

The electronic materials market expects to see optimistic demand mainly from high-value materials such as large-sized LCD TV panels, mobile OLED panels, and semiconductor materials.

Samsung SDI plans to improve both revenue and profit by expanding supply of high-value products, diversifying the customer portfolio, and timely putting forward materials for new, highly-functional products in the market.

“Although 2023 was marred by global economic recession, Samsung SDI came out of it with meaningful results that include revenue growth and profitability improvement in the EV battery business – our key focus area – as well as on-track preparations for sustainable growth,” said President and CEO of Samsung SDI Yoon-ho Choi. “In 2024, Samsung SDI will strive to achieve profitable and qualitative growth, backed by ‘super-gap technological competitiveness, cost innovation, and new customer acquisition.”

Shareholder Return Policy

Samsung SDI has decided on its annual payout FY2023 with KRW 1,000 common dividend (KRW 1,050 preferred dividend) per share. The total payouts will be KRW 66.9 billion.

In January 2022, Samsung SDI disclosed and announced the shareholder return policy for the three-year term that pays out common dividend of 1,000 won (KRW 1,050 for preferred dividend) with additional 5 to 10% of the annual free cash flows.

In 2023, Samsung SDI posted losses in the full-year free cash flows due to increased volume of capital expenditures. In light of this, the company’s annual payout for the previous year consists only of regular dividends.

ESG Management Activities

Samsung SDI vows to accelerate its ESG management in 2024.

The company’s key ESG activities in 2023 include joining Global Battery Alliance in March for establishing a sustainable battery value chain and receiving the best rating in supply chain co-prosperity assessment by Korea’s Commission for Corporate Partnership in November.

Samsung SDI plans to bolster the ESG management with the following action plans in 2024: execute the eight strategic tasks for environment management, align its business with EU battery regulations, calculate scope 3 emissions and set a reduction target, and expand the supply chain engagement in the ESG practice. In a bid to further firm up the company’s footing for sustainable growth, the company is set on instilling a stronger safety culture as well as strengthening compliance.