Company reports Q4 2025 revenue of KRW 3.86 trillion ($2.7 billion), narrows operating loss to KRW 299.2 billion with record ESS battery sales

In 2025, annual revenue stood at KRW 13.27 trillion ($9.28 billion) with an operating loss of KRW 1.72 trillion

Key achievements include strengthening the sales of NCA and LFP batteries for ESS, securing 46-series cell orders, partnering with BMW for all-solid state battery validation, and making progress in next-generation electronic materials

In 2026, the company will make a turning point by focusing on efficiency, speeding up customer and market responses, and preparing for future technologies

SAMSUNG SDI today announced its final quarter and annual financial results for 2025.

In the fourth quarter, the company posted revenue of KRW 3.86 trillion and an operating loss of KRW 299.2 billion. Revenue increased 26.4% quarter-on-quarter and 2.8% year-on-year. The operating loss was halved from the previous quarter, signaling a gradual recovery in business performance.

For the full year 2025, SAMSUNG SDI reported revenue of KRW 13.27 trillion and an operating loss of KRW 1.72 trillion.

Fourth Quarter Earnings Results by Business

Revenue from the battery business reached KRW 3.62 trillion, up 28.4% quarter-on-quarter and 1.6% year-on-year. Operating loss stood at KRW 338.5 billion.

Batteries for energy storage system (ESS) achieved the highest quarterly revenue on record, while increased benefits from the U.S. Advanced Manufacturing Production Credit (AMPC) and compensation related to reduced electric vehicle battery volumes contributed to narrowing losses significantly from the previous quarter.

Electronic materials revenue reached KRW 236.7 billion with an operating profit of KRW 39.3 billion, remaining at a level similar to the previous quarter.

2025 Business Highlights

Despite challenging conditions last year, including policy changes in major markets and weaker EV demand from strategic U.S. customers, SAMSUNG SDI achieved significant order wins from global customers by strengthening its overseas sales activities in the ESS market.

As the only non-Chinese prismatic battery manufacturer, SAMSUNG SDI has broadened its ESS lineup to include both NCA-based and LFP-based solutions, while scaling up U.S. production capacity for local ESS supply.

The company also continued to strengthen its future technology capabilities by entering into a joint development agreement with BMW to validate all-solid-state battery technology, and by signing a memorandum of understanding with Hyundai Motor and Kia to jointly develop batteries dedicated to robotic applications.

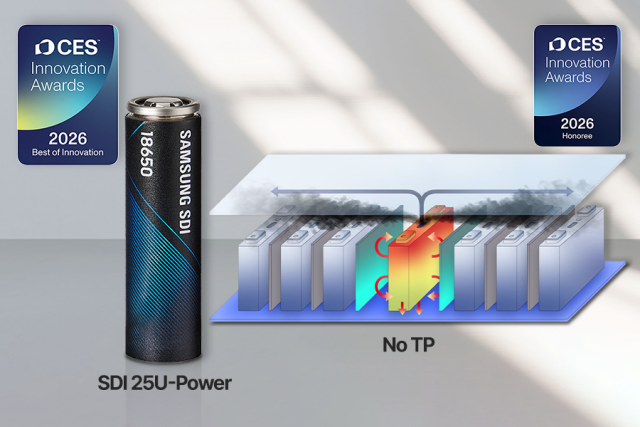

These efforts have translated into tangible order wins supporting SAMSUNG SDI’s mid- to long-term growth. The company has secured agreements to supply its NCA-based 46-series cylindrical batteries to leading automotive customers, signed large-scale contracts for prismatic LFP batteries for ESS, and won substantial orders in the initial bid for domestic ESS projects in the central contract market. SAMSUNG SDI has also launched its high power tabless cylindrical batteries and begun supplying them to global power tool customers.

Market Outlook and Business Strategies for 2026

While growth in the global electric vehicle battery market excluding China is expected to remain modest at around 6% this year due to easing green policies in North America and Europe and adjustments to electrification strategies by major automakers, the outlook for ESS batteries is considerably stronger.

Demand for ESS batteries is projected to continue expanding, driven by rising investment in AI data centers and increasing demand for power storage, uninterruptible power supply (UPS), and battery backup unit (BBU) applications. In addition, supply opportunities are expected to widen as non-Chinese manufacturers ramp up local production in the United States.

The small battery market is expected to see a rebound in demand, driven by professional power tools as construction of AI data centers accelerates, with growth also anticipated in emerging applications such as robotics.

Meanwhile, the electronic materials business is likely to maintain solid growth, supported by expanding investment in AI servers and related semiconductor materials.

In response to these market trends, SAMSUNG SDI aims to strengthen its technological competitiveness and enhance its business structure to support sustainable growth.

For ESS batteries, the company plans to maximize production capacity and improve profitability through U.S.-based mass production of SBB 2.0, which features prismatic LFP battery technology.

In its electric vehicle battery business, SAMSUNG SDI plans to enhance performance by expanding sales to new customers and increasing orders for new products, including LFP and mid-nickel batteries, while securing hybrid electric vehicle projects for its high-power tabless cylindrical batteries.

For the small battery business, SAMSUNG SDI aims to expand sales of high-power tabless cylindrical batteries to meet recovering demand from professional power tool makers. In the electronic materials business, the company will accelerate product development focused on new growth areas, including semiconductor packaging materials.

“Through greater focus and prioritization to improve management efficiency, swifter responses to customers and the market, and continued preparation for future technologies, we aim to make this year a turning point toward a full business turnaround.” said a SAMSUNG SDI official.